|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Offer Home Loan Cashback: A Comprehensive GuideRefinancing your home loan can be a strategic move to lower interest rates, reduce monthly payments, or tap into your home's equity. One enticing aspect of refinancing is the potential for cashback offers, which can make the deal even more appealing. This guide explores various facets of refinance offers and how cashback options work. Understanding Refinance OffersRefinancing involves replacing your existing mortgage with a new one, typically to secure a lower interest rate or better terms. Many lenders sweeten the deal with cashback offers, providing a lump sum of money upon closing. Benefits of Refinancing

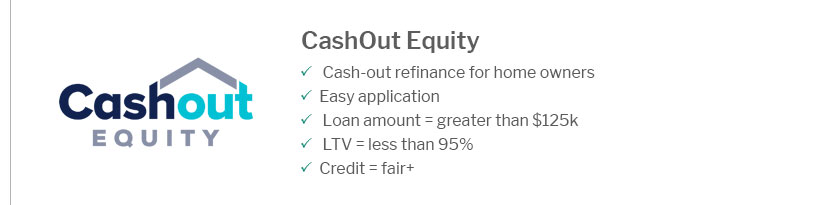

Exploring Cashback OffersCashback offers vary by lender and are designed to attract borrowers by providing a financial incentive. These offers can be used to cover refinancing fees or as a direct cash benefit. To understand the full cost of refinancing, be sure to review any mortgage refinance fees associated with these offers. Key ConsiderationsWhen evaluating cashback offers, consider the following:

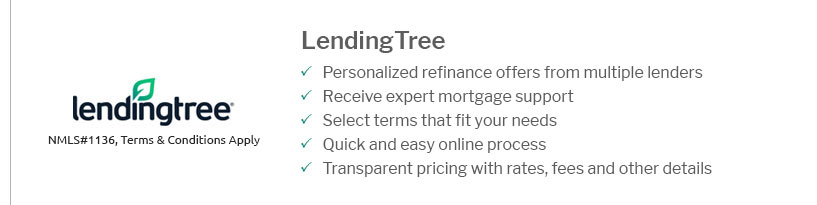

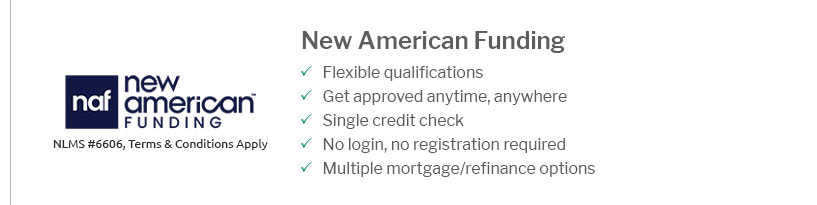

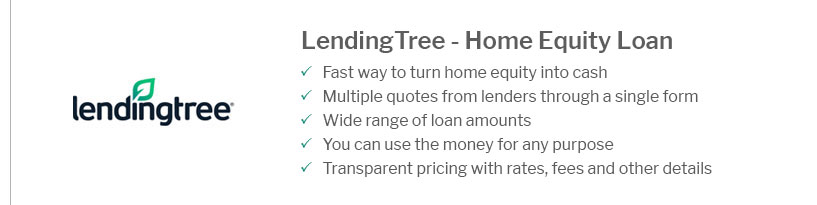

Choosing the Right LenderWith numerous lenders offering various cashback incentives, it's crucial to shop around. Compare offers, interest rates, and terms from different providers. Consider consulting with financial advisors or exploring home mortgage loans resources for informed decisions. FAQ

https://www.mortgagechoice.com.au/guides/refinancing/cashback-offers/

A cashback refinance usually works by the lender offering a lump sum of cash as an incentive to refinance your existing home loan from your current lender. https://nfinityfinancials.com/good-mortgage-broker-answers-are-refinance-cashback-deals-worth-it/

Cashback deals on refinances and other home loan incentives are subject to change month to month, and different lenders provide different incentives. Check-in ... https://www.unloan.com.au/learn/refinance-cashback-offers-are-they-really-worth-it

A refinance cash back offer refers to a promotion offered by a lender that gives you a cash bonus when you transfer your home loan to them from your existing ...

|

|---|